Greeks for common Option strategies

Greeks for some common option strategies have been plotted below.

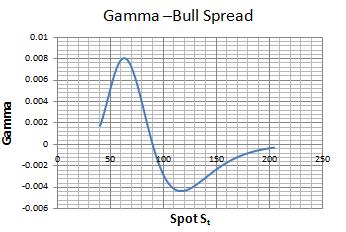

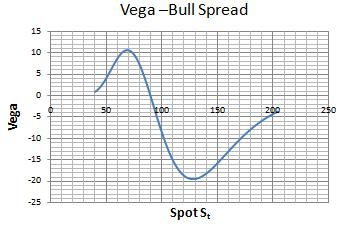

Bull spread:

The strategy may be implemented in either of the following two ways:

A bull call spread: Constructed by buying a call option with a low exercise price, and selling another call option with a higher exercise price.

A bull put spread: Constructed by buying a put option with a low exercise price, and selling another put option with a higher exercise price.

Stock/Index view: Moderately bullish.

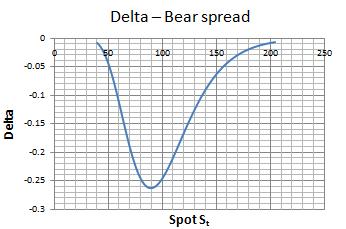

Bear spread:

The strategy may be implemented in either of the following two ways:

A bear call spread: Constructed by selling a call option with a low exercise price, and buying another call option with a higher exercise price.

A bear put spread: Constructed by selling a put option with a low exercise price, and buying another put option with a higher exercise price.

Stock/Index view: Moderately bearish.

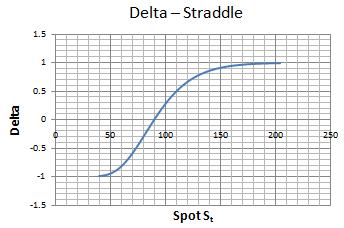

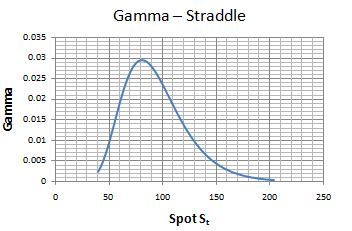

Straddle:

A long straddle may be constructed by buying a call and a put option on the same underlying with same strike and maturity.

Stock/Index view: Non directional. May be appropriate in a volatile market when a large change in the stock/index price is expected but the direction of the movement is unclear.

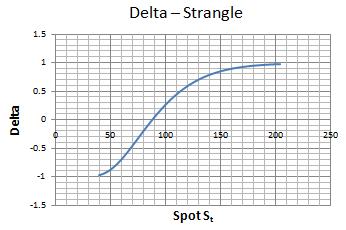

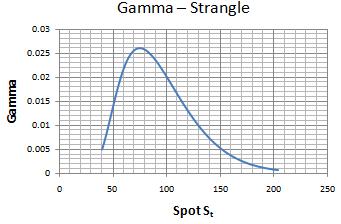

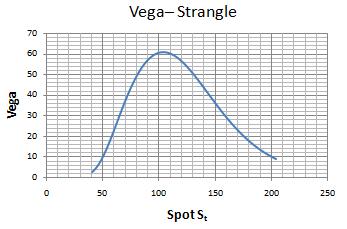

Strangle:

A long strangle may be constructed by buying a call option with higher strike and a put option with lower strike on the same underlying with same maturity.

Stock/Index view: Similar to a straddle. Non directional. May be appropriate in a volatile market when a large change in the stock/index price is expected but the direction of the movement is unclear. The strategy is cheaper to implement than a straddle but requires larger stock/index movement to provide a positive payoff.

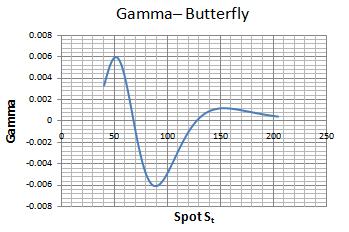

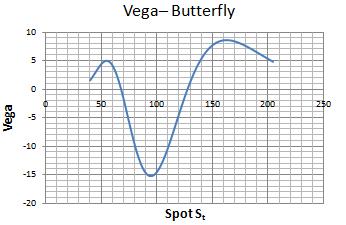

Butterfly spread

Can be implemented in either of two following ways using call or put options

Using call options:

Long 1 call at (X − a) strike

Short 2 calls at X strike

Long 1 call at (X + a) strike

Using put options:

Long 1 put at (X − a) strike

Short 2 puts at X strike

Long 1 put at (X + a) strike

Market/index view: A marke neutral view. Basically, It is a limited profit, limited risk options strategy.